Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

andrew.moh

Edellinen @kpmg

▸ Koulutuskirjailija 🧵 | ▸ Kerronnalliset oivallukset 📚 | ▸ Alfa-ilmaisin ✡️

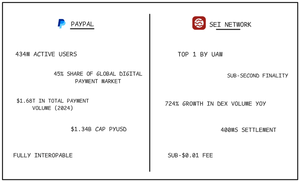

▸ @Mantle_Official & @SeiNetwork avustaja

Johtavat

Rankkaus

Suosikit