Trendande ämnen

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

There is finally a good money market on @HyperliquidX that turns tokens into instant, looping assets all inside a sub-second block.

@hyperlendx is shaping up to be the capital engine on Hyperliquid, turning every idle token into productive assets for its users.

- - - - -

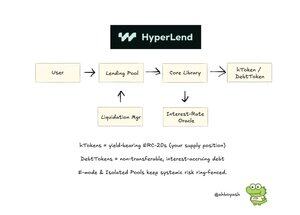

Hyperlend is a permissionless lending layer on Hyperliquid EVM that lets users

• Supply tokens (like $HYPE)

• Borrow stables in <1 sec blocks

• Loop yields or hedge in real time

Think @aave, but natively wired to Hyperliquid’s order books.

We can see that this gives rise to capital-efficiency plays

• wHLP: tokenised shares of Hyperliquid’s HLP vault; borrow against them & loop 3-5 times

• Liquid Perp Collateral: turn your open perp PnL into collateral -- > effectively keeping your trade open while farming yield simultaneously

• Symmetric/Under-Collat Loans: hedge-protected LTV boosts & $HYPE-staking utility leasing for market-makers

This composable use of assets unlock many use cases

• Yield-on-Margin: farm while your perp PnL compounds

• Delta-Neutral Risk Transfer: tokenised perps tradable OTC

• MM Strategy Vaults: share order-flow PnL with retail liquidity

Traction

• $380 M TVL (2nd largest dApp on Hyperliquid after Hyperliquid's trading platform)

• Roughly 25k+ wallets, about 1k+ DAU

• @LayerZero_Core cross-chain deposits live + HyperVault + wHLP shipped + Looping assets live (HyperLoop)

Things to consider

• Cross-Domain “bridge risks”: Every L1 <> EVM hop depends on Hyperliquid’s spotSend bridge, and any exploits can freeze redemptions and strand positions mid-loop...

Topp

Rankning

Favoriter