Trendaavat aiheet

#

Bonk Eco continues to show strength amid $USELESS rally

#

Pump.fun to raise $1B token sale, traders speculating on airdrop

#

Boop.Fun leading the way with a new launchpad on Solana.

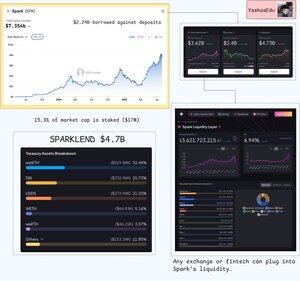

Just realised @sparkdotfi is quietly becoming DeFi's liquidity backbone.

> $7.35B TVL

> $72.6M annualized fees

> $6.15M monthly revenue

> Savings product alone holds $2.4B (sUSDS grew 42% of total deposits)

Spark Liquidity Layer connects to everything. At 6.94% APY on $3.6B in liquidity. Spark is quietly powering half of DeFi's lending infra.

+ SparkLend has $1.14B allocated

+ Morpho takes $1.01B, Ethena uses $950M

+ Even BlackRock is tapping in

Four ways to earn right now👇

1/ Deposit USDS for 15% APY in SPK tokens

2/ Stake SPK for Overdrive rewards (airdrop recipients only)

3/ USDS farm pool (ends Sept 25)

4/ Legacy USDS pool for points (ends Aug 14)

The flywheel is simple.

Deposit USDC → Farm $SPK → Stake for points → Use points in partner protocols

Also now @coinbase users can now borrow USDC against their Bitcoin. Here’s how it works👇

> @MorphoLabs handles the loan protocol

> @coinbase provides the app interface

> @sparkdotfi supplies the USDC

The setup is modular. Any exchange or wallet can plug into Spark's liquidity pool to offer similar loans. No need to build from scratch.

@sparkdotfi’ USDC supply hit $600M since January. Shows people want onchain loans without selling their BTC.

SSL automatically sends funds when someone needs a loan. No middleman approval process. This is just three protocols doing what they're good at, working together.

That revenue/mcap ratio won't stay disconnected forever. NFA

4,9K

Johtavat

Rankkaus

Suosikit